GET THE RESULTS YOU NEED TO IMPROVE YOUR CREDIT

GET THE RESULTS YOU NEED TO IMPROVE YOUR CREDIT

Restore Your Credit With

The Credit Experts

Your Good Credit Makes a Home Possible

THE PROCESS

01

Free Consultation

We'll give you a free professional consultation and credit analysis to see if you are a good fit for our credit improvement program.

02

Enroll

We have a wide assortment of credit-building tools that add positive credit, while we are taking care of negative and erroneous items on your credit report.

03

See Results

Log in to your personal dashboard that is emailed to you where you can see real-time progress and results every step of the way. Click here to see our Testimonials from clients

OUR SERVICES INCLUDE

- Personalized Credit Repair Options to Fit Your Situation

- Experienced Cast Analyst and Case Adviser Who Personally Work With You Through the Entire Process

- Custom Credit Challenges Created For Your Case

- 24/7 Access to Your Case States and Progress

- Credit Tools and Educations

HOW WE CAN HELP YOU

We Help Improve Your Credit Scores

By Removing:

REPOSSESSIONS

This occurs when you fall behind on your vehicle’s monthly payment. It can stay on your report for up to seven years making your financial life very difficult for years. Repo’s are also listed in the public record section of your report.

COLLECTIONS

These happen whenever an account is seriously past due. The creditor decides to sell it to a collection agency and it drastically affects your score. Do not pay any collections as this will actually decrease your score.

LATE PAYMENTS

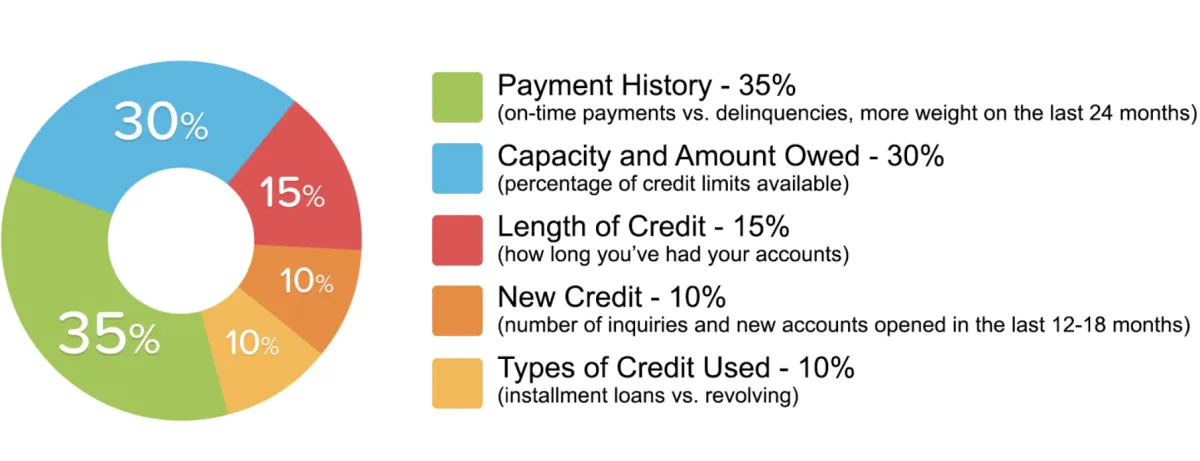

Making your payments late is very unhealthy for your credit score, especially since payment history makes up 35% of your score. So one late payment can make a huge negative impact.

HARD INQUIRIES

Each hard inquiry causes your credit score to decrease. It's important to not run your credit so much since it can be interpreted as an attempt to substantially expand available credit, and create higher risks for lenders.

CHARGE OFFS

When a creditor believes that a debt is unlikely to be collected they will write it off as a loss. This does not mean you are off the hook. You are still responsible for paying the debt back, and it also lowers your score drastically.

STUDENT LOANS AND MORE!

When a creditor believes that a debt is unlikely to be collected they will write it off as a loss. This does not mean you are off the hook. You are still responsible for paying the debt back, and it also lowers your score drastically.

Frequently Asked Questions

We started this company to help people. Instead of sending GENERIC dispute letters, we DISSECT your entire credit report as a team for HOURS after we receive it. Then we pinpoint every single inaccuracy with in your report for every single collection or negative item on it. The Law states everything in the report must be 100% accurate or it must be removed. We use Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA) to fight the inaccurate items on your report. Simply put, we care about making your life better. Would love to help you NEXT!

Every 35 days, at the end of a challenge cycle, we will pull your updated credit report and update your Secure Client Portal with the results. We will also send you an email with all the significant updates, as well as insight as to why your scores changed. These might include pointing out that a credit card balance increased significantly, and advice on what you can do to help us help you.

This is totally normal. Depending on the balance of negative and positive accounts, it may take a while to remove enough negative items and add enough positive information to really shift the balance and see that reflected in your score. That doesn’t mean nothing is happening, though. Every reported negativity we remove strengthens your overall credit profile and makes you more attractive to lenders and credit card companies, which is the goal. Here’s a secret though: Your score doesn’t really matter. What matters is the strength of your credit profile. We know PLENTY of people whose scores can be above 725, yet because of their overall profile no one will finance them a dime. However, if you have a lower score but your overall profile is healthy, you have a better chance of being approved for what you want, which is the only purpose for credit in the first place.

Unfortunately, with hundreds of clients, we have to streamline communication. As you can imagine, everyone has their preferred method of communicating, so if we have people trying to text, whatsapp, FB message or calling our personal cell phones, communication can quickly get lost and you will feel unimportant, which is certainly not the case. Because we want you to get the attention your concern deserves, we funnel all communication through either your Secure Client Portal or by email to support@j180one.com.

Absolutely! Due to the current climate, our staff is largely remote to keep everyone safe and comfortable. Because of this, the easiest way to get on the phone with your Credit Improvement Expert is to book a call using the page below. Please be sure to let us know exactly what you have questions about so that we can help you the best way possible. Here is the link to schedule your call: https://www.j180one.com/clientupdate.

Due to regulatory restrictions, we can only have access to an updated credit report every 30 days at the earliest. So, if you get a notification from one of your apps that something has changed, been removed or updated, we will not be able to provide any details about it until we are able to pull an updated report at the end of the 30-day period.

Your payment date will be on the anniversary date of the day you signed up initially or a date you chose. For example, if your first payment was on the 16th of the month, you will be billed on the 16th of every month. The only exception is: if the 16th falls on a Sunday, the bank that does our payment processing may process your payment on the Saturday before.

We need to see any communication you receive from creditors, collectors or the credit bureaus. You can scan or take pictures of this communication and either upload it into your Secure Client Portal or email it to support@j180one.com.

Do not give any collection company any information about you, including your name. Simply tell them that you want all communication to be through mail, and that you do not give them permission to contact you on the phone.

This is completely normal. During the repair process, challenged items get placed into a Disputed Status that affects the way the information is calculated. In fact, it is common to see a large drop in the first month or two of repair, but again this is normal, and nothing at all to get concerned about. Once the investigations are completed and those accounts are removed, the scores will reflect the correct changes.

Well, that is because you don’t actually have a credit score. You have a Credit Profile which contains all your information. The information on your Credit Profile gets run through an algorithm called a Scoring Model which gives particular values and weights to the information in your profile, which then gets calculated to create your score. There are dozens of different Scoring Models, and they all calculate the information slightly differently, so your score will be different on all of them all even though they are calculating the same information. The two main Scoring Models are FICO and Vantage, and there are even several different versions of the FICO and Vantage scores. The main thing to know is that as long as negative items are being removed and you are consistently adding positive information in the form of on-time payments and low balances on your credit cards, your credit will improve.

Absolutely, and we will suggest that you open specific credit accounts based on your credit profile. These accounts will be tailored to you, and will fill the gaps in your specific credit file and maximize your score.

We started this company to help people. Instead of sending GENERIC dispute letters, we DISSECT your entire credit report as a team for HOURS after we receive it. Then we pinpoint every single inaccuracy with in your report for every single collection or negative item on it. The Law states everything in the report must be 100% accurate or it must be removed. We use Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA) to fight the inaccurate items on your report. Simply put, we care about making your life better. Would love to help you NEXT!

Results will start appearing within 30 to 90 days.

Once you complete the sign-up process, you will get a phone call from me or my team members. Then we will begin working on your credit report to remove any inaccurate information. The program also provides you with the information you need to keep working on raising your credit score.

We offer 3 different plans: Individual Plan, Couples Plan And Military/First Responder Plan. You are not charged a fee until work is performed.

CONTACT FOR MORE QUERY

Our Money Back Guarantee

We Have The Best 100%

Money Back Guarantee

180 Day Money Back Guarantee if zero score improvement. The guarantee is voided by new collection/charge offs/ derogatory items being added to the credit report.

Want To Become An Affiliate?